Build your

payments possible

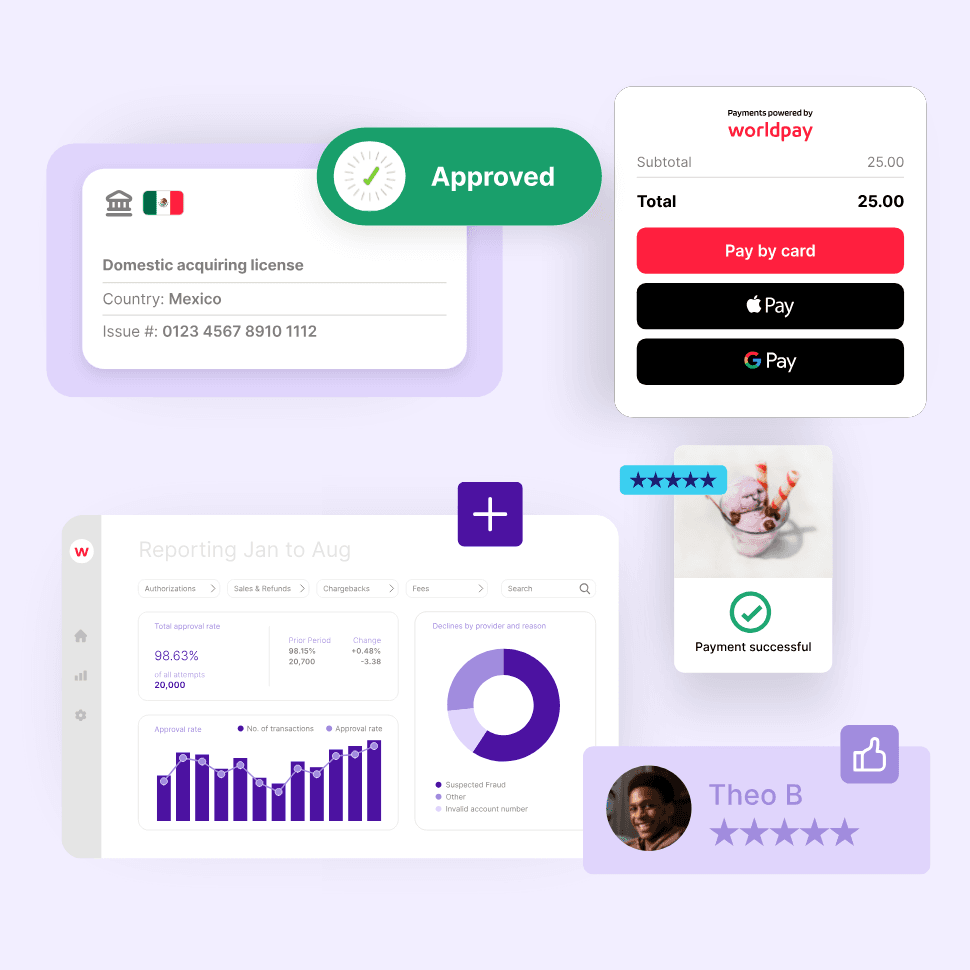

With Worldpay, businesses of all sizes can boost revenue, innovate at pace and create commerce experiences their customers love.

Trusted by millions of merchants worldwide

Who we serve

We're everywhere. You can be too.

What's your big dream?

Wherever you're going, getting payments right can get you there faster. Worldpay helps you to boost your business, protect your revenue and make every transaction count.

Discover our solutions

Powering every part of your payments journey

Introducing the Agentic Commerce Report

A new chapter in commerce begins now. What merchants need to know to get ahead.

Customer stories

See how our customers have put Worldpay solutions into action

There is only one Global Payments Report

Worldpay creates GPR for its clients, to equip them with the insights they need to unleash their payments potential. And ten years on, it’s as relevant as ever.

Insights

Our expertise is your edge

We know payments. Check out our latest articles, white papers and market reports.