Stopping the cycle of chargebacks and first-party misuse

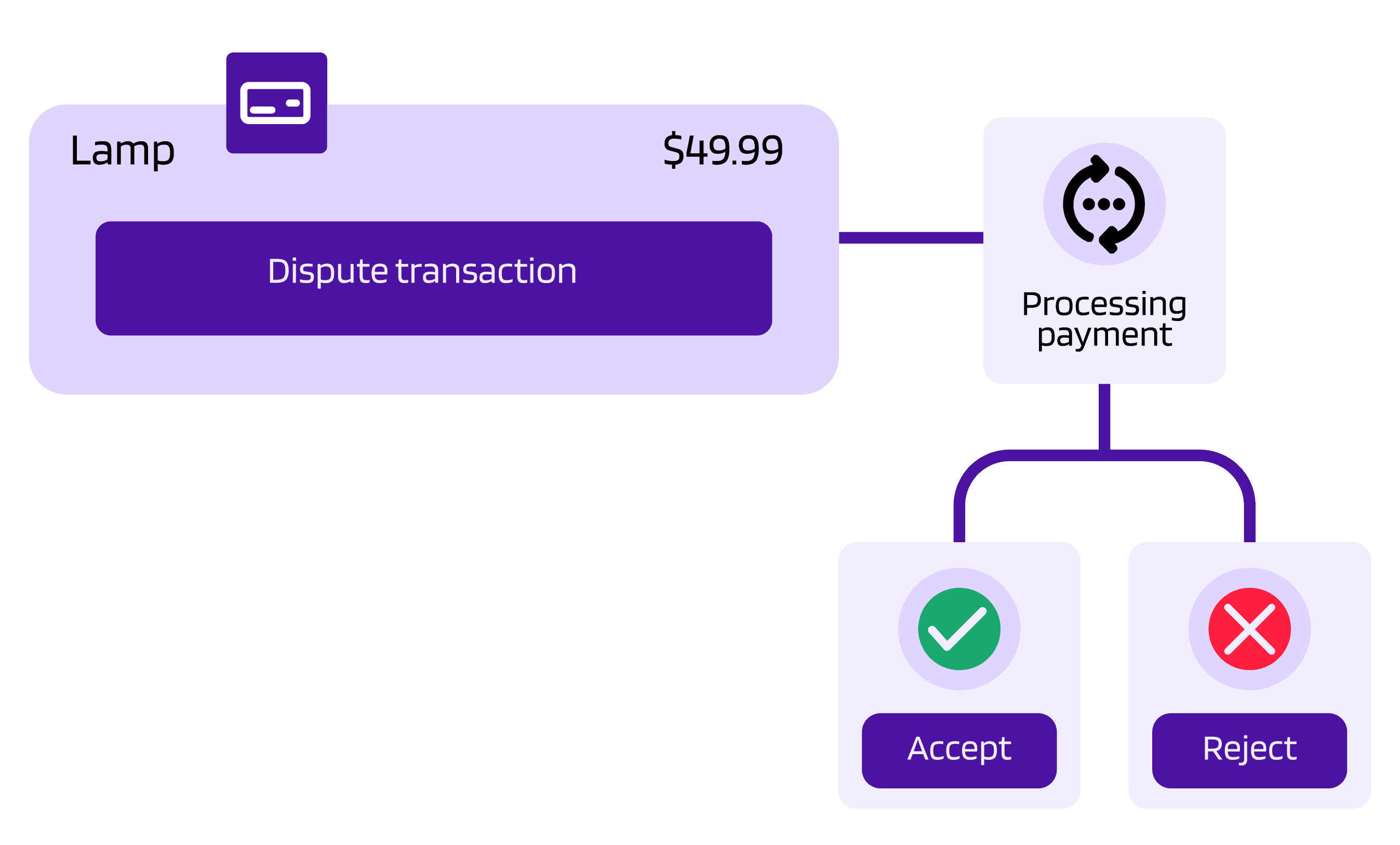

Automation allows merchants to resolve potential disputes before they escalate into costly chargebacks.

Key points

- Chargebacks are often driven by "friendly fraud" – where customers dispute legitimate purchases due to confusion or buyer's remorse.

- Maintaining clear billing descriptors and transparent return policies can prevent the majority of non-fraudulent disputes.

- Leveraging automated dispute management tools allows businesses to recover lost revenue without draining operational resources.

Protecting your revenue is about more than just making sales – it’s about keeping them.

For many businesses, chargebacks and first-party misuse (often called "friendly fraud") have become significant hurdles that can quietly erode profit margins.

While some disputes are legitimate, many are the result of confusion. Understanding these nuances is the first step toward securing your bottom line and ensuring a smoother experience for your customers.

Dispute rates by the numbers

The scale of the challenge for modern merchants is reflected in recent industry and internal data:

- $33.8 billion: The projected value of global chargebacks in 2025 (Mastercard State of Chargebacks Report 2025)

- 50%: The average share of representments won by merchants, highlighting that half of all defended disputes still result in a loss for the business (Mastercard)

The true cost of the "friendly" dispute

A chargeback occurs when a customer contacts their card issuer to reverse a payment rather than speaking to the merchant. While designed as a safety net, this process is increasingly used as a tool of convenience.

To manage your risk, it’s helpful to categorize disputes into three areas:

- True fraud: A criminal uses stolen details to make an unauthorized purchase.

- Merchant error: A mistake in fulfillment, such as shipping the wrong item or a confusing billing descriptor that a customer doesn't recognize on their statement.

- First-party misuse (friendly fraud): This happens when a customer makes a legitimate purchase but later disputes it with their bank. This might be due to "buyer’s remorse," a family member making a purchase without their permission or simply forgetting the transaction occurred.

Why proactive management matters

For merchants, a chargeback is more than just a lost sale. Each dispute carries an administrative fee, and high chargeback ratios can lead to increased scrutiny from card networks or higher processing costs. For many businesses, the time spent gathering "compelling evidence" to fight a false claim is a major drain on daily operations.

Inside The Cake Solution’s payments transformation

The Cake Solution, a British-owned cake franchise, needed to manage growth across multiple locations while keeping security tight. By partnering with Worldpay, they moved beyond manual checks to a more robust, integrated payment infrastructure.

The results highlight why the right setup is a competitive advantage:

- Fraud reduction: Their proactive security approach significantly lowered chargeback rates.

- Higher approvals: Their authorization success rate rose by 3–4%, ensuring legitimate customers weren't accidentally blocked.

- Faster service: In-store transaction times were cut by approximately 30%.

"Working with Worldpay has been a game-changer for us," said Neil Blakeman, managing director at The Cake Solution. "Their solutions are reliable, intuitive and growth-ready."

Practical steps to protect your business

You can take proactive steps today to minimize the impact of disputes:

- Audit your billing descriptors: Ensure the name on a customer’s bank statement matches your brand name. If a customer shopped at "The Corner Café" but sees a charge from "TC Holdings LLC," they might flag it as fraud.

- Make "Contact Us" easier than "Dispute": Ensure your refund and return policies are written in plain English and easy to find. If a customer knows they can get a quick resolution from you, they are less likely to call their bank.

- Prioritize shipping transparency: Send automated tracking numbers and delivery confirmations. This doesn't just improve the customer experience; it provides "compelling evidence" if a delivery is ever questioned.

- Layer your authentication: Use tools like Address Verification Service (AVS), Card Verification Value (CVV) and 3D Secure 2 (3DS2). These provide proof that the actual cardholder is the one making the purchase.

- Keep digital "breadbox" records: Save transaction receipts, IP addresses and customer service logs. If you need to represent a case to a bank, this documentation is your best defense.

- Automate your defense: Managing disputes manually is difficult as you scale. Modern tools can help you identify potential issues before they become formal chargebacks.

- Leverage data-driven insights: Use reporting to find patterns. Are certain products or locations seeing higher dispute rates? Understanding the "why" allows you to fix the root cause.

The Worldpay advantage

Instead of reacting to disputes after they happen, businesses can use tools like Disputes Deflector to catch issues early or Disputes Defender, which uses AI to help you build the strongest possible case for recovering revenue.

By focusing on clear communication and robust data, you can spend less time chasing lost funds and more time focusing on your customers.

Related Insights