The store isn’t dead, but it’s changing

With transformation rapid and competition high, the future of retail belongs to those who innovate.

By Imogen Hussey, senior strategy manager for retail

The future of retail belongs to those who innovate. That was the central message at NRF 2025's Big Show in Paris.

The retail sector is always at the forefront of change and innovation, and perhaps now more than ever, with AI augmenting how businesses run, shoppers valuing new or different things and regulations shifting business priorities. With transformation rapid and competition high, retailers are re-evaluating how they do business.

That in-store feeling

Though digital dominates our lives now, people still want physical stores. What they want from them, though, is changing, moving toward experiential and hybrid models. Many retail executives (75%) are planning a large-scale store transformation in the next two years, and they expect these investments to boost their bottom line.

Inspiration can be taken from those doing it well already. Sephora’s beauty hubs provide a space for shoppers to test products and get advice from well-trained staff, many of whom have graduated from the newly opened Sephora University.

Footwear brand On creates immersive store experiences. Its science museum-style store on Regent Street hosts workout events to capitalize on the recently popular trend of community-centric exercise groups, like running clubs.

Meanwhile, beauty brand KIKO works closely with in-store teams, gathering feedback to keep refining what customers experience in their physical locations.

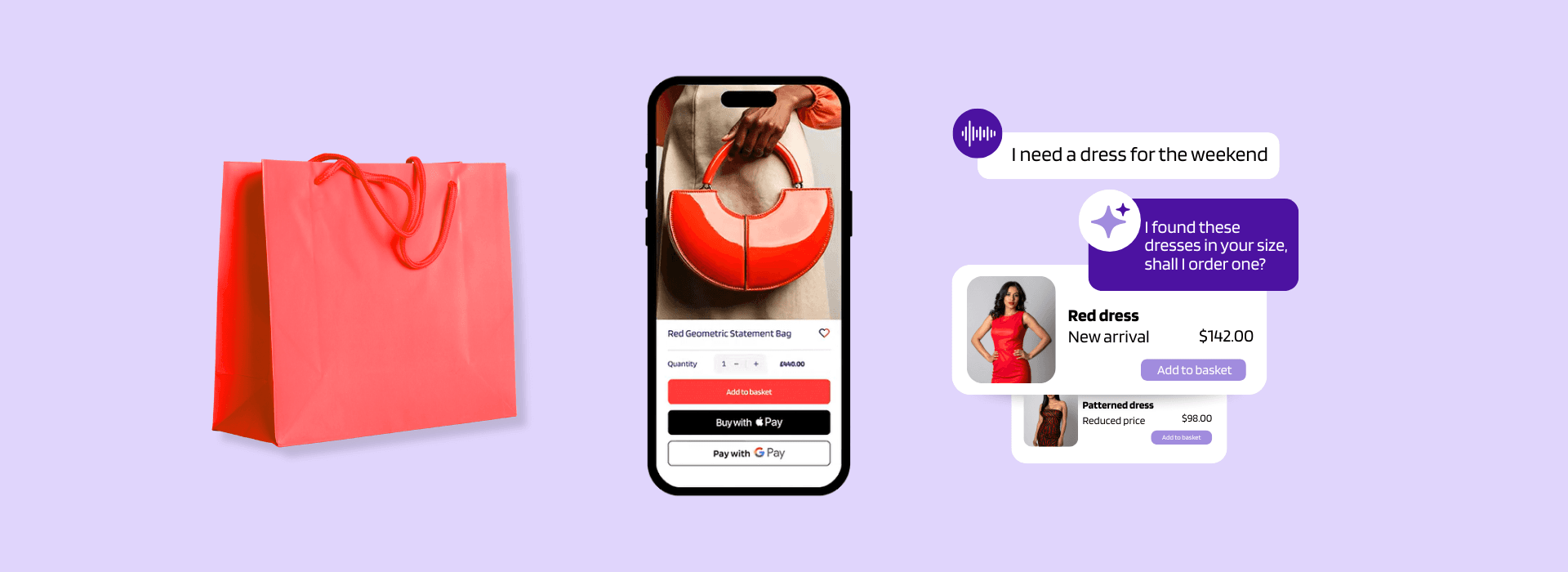

Brands are also becoming more targeted and personalized, using cross-channel data to offer product suggestions, flattering makeup shades and specific footwear, so that, wherever you are, you’re seeing suggestions tailored to you.

Quick takeaways

The focus on physical stores continues to grow, especially for Gen Z and Gen Alpha, who love getting hands-on with products before buying due to their affinity for things that are real and tangible.

Retailers investing in in-store makeovers and personalized experiences are positioning themselves to win shoppers over.

True personalization means knowing your community and tailoring products and messaging to local and individual tastes and lifestyles. This can be achieved through data-driven insights for product recommendations that keep shoppers coming back.

Tech accelerates retail evolution

With retailers at the cutting edge of technology, artificial intelligence has already become integral to driving outcomes, with its scope including inventory management, marketing and personalization. Many of the ways AI can support retailers happen behind the scenes:

Pets at Home uses AI to spot trends and optimize inventory. Using AI has allowed the company to reduce surplus stock.

At Morrisons, AI-powered cameras alert staff when to restock shelves and even spot checkout errors or potential theft.

REMA 1000 recognizes shoppers as they walk in, tailoring offers and letting them check out on their phones. This has resulted in a 12% boost in basket size and lower costs.

Agentic AI was also a hot topic at NRF Europe. Google presented its recent report showing that 88% of executives using agentic AI are seeing positive returns. To get buy-in from their organizations, retailers should focus on four things: securing C-suite support, building a solid business case, setting AI rules and starting with the biggest wins.

The retail technology revolution is also about turning what you’ve done before on its head. In recent years retail media spending has been mainly online (99%), but there’s further opportunity to incorporate it in store. Iceland discussed how they are bridging this gap with dynamic digital screens and Bluetooth tracking to curate shopping paths and drive ad impressions throughout their stores.

Quick takeaways

Use AI as a sidekick for your team rather than a replacement – and focus efforts where they’ll deliver the biggest impact.

Explore AI-driven shopper recommendations and smart inventory management to boost sales and cut costs.

Don’t overlook in-store retail media to liven up in-person shopping and make browsers take notice.

More sustainable retail

Sustainability and ESG also featured prominently as pressure mounts from both shoppers and policymakers around transparency, product footprints and more ethical supply chains.

Wholesale change is hard, both for the workload and for encouraging adoption. Retailers may struggle from within, particularly around proving the long-term return on investment. What might initially seem like slashing profits, though, can drive profit margins by being more considered about waste, logistics and sourcing as well as attracting new audiences.

Those retailers pushing the environmental envelope may not only have the edge with customers who share their values but also may be blazing a trail for others to follow.

Best Buy, a U.S. electronics retailer, explained how it collects, repairs and recycles old products, reducing waste and diversifying offerings.

IKEA and others also talked about their recycling and waste-reduction efforts and the fresh opportunities those efforts brought them.

Quick takeaways

Sustainability can become a business opportunity.

Demonstrating value and managing change remain key hurdles.

Regulations around circularity and provenance are needed for widespread adoption.

Payments as a lever for retail success

Rami Baitiéh, Morrisons’ CEO, emphasized that letting shoppers pay how they prefer drives loyalty and conversions. As the shopping experience breaks free of digital and physical borders, payments become more fluid. We’re moving toward integrated payments that don’t disrupt the shopping experience at all.

When payments are easy, shoppers can remember the excellent shopping experience rather than issues with logging into accounts, locating cards, remembering pins or retrying failed transactions. Through digital IDs, tokenization and improved unified commerce, payments will become even more invisible in the future, as well as safer for shoppers and merchants alike.

As omnichannel matures, it’s becoming deeper than cross-channel. Done well, it’s serving to bridge communities and cultures, too, making for a more collaborative and integrated retail future. NRF Europe buzzed with excitement about that future.

Despite uncertainty due to macroeconomic factors and new technological threats, retailers displayed real optimism, focused on innovation as the collective way forward.

Find out how you can use payments to drive retail innovation and success or get in touch.

Related Insights