Key takeaways for policymakers from 10 years of Worldpay's Global Payments Report

8 policy insights from a decade of payments transformation.

The way we pay is evolving at an unprecedented pace, reshaping economies, industries and consumer expectations worldwide. As policymakers and industry leaders navigate this transformation, the 10th edition of the Worldpay Global Payments Report offers a critical roadmap. This report doesn’t just analyze trends—it uncovers the seismic shifts that will define the future of commerce.

This year, we’re celebrating the 10th edition of Worldpay’s Global Payments Report. GPR2025 provides invaluable insights for policymakers around the world, highlighting the shifts and trends shaping consumer payments across 40 key global markets.

Here are my 8 takeaways for policymakers:

1. Safe and frictionless digital payments enable economic growth

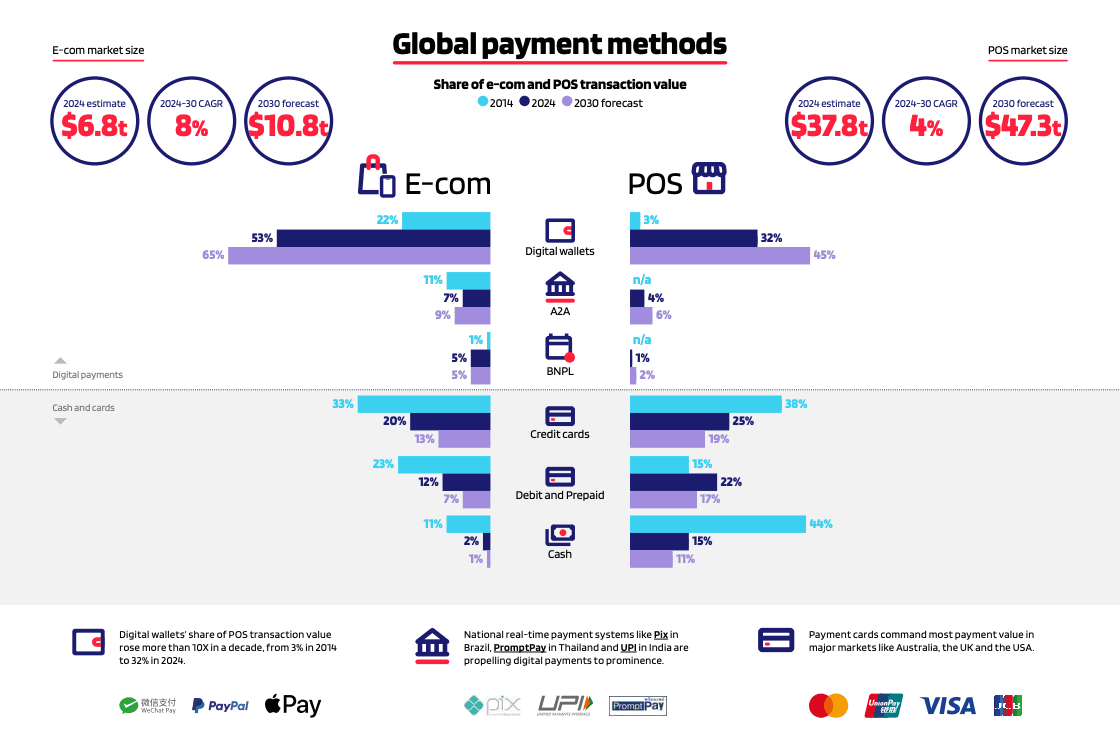

Digital payments (wallets, A2A, BNPL, crypto) are increasingly crucial for the retail economy, both for online and at physical point of sales (PoS) transactions. We expect this reliance on digital payments across the economy to further increase by 2030. Policymakers should create an optimal environment for digital payment providers to support this growth.

2. Digital payments are a powerful tool for financial inclusion

Digital payments offer new opportunities for consumers across diverse socio-economic groups and geographies, including rural areas, to access the financial system and participate in commerce. Policymakers should ensure these technologies are accessible to all segments of the population, promoting affordable and convenient payment options.

3. A2A and real-time payments as a catalyst for innovation and access

Success stories like UPI in India and Pix in Brazil show how real-time payments can expand access to digital transactions. A2A payments can be cost-effective and fast but still face important challenges with fraud. Policymakers and the private sector must continue to work together on enhancing security and driving further adoption.

4. Cards remain the gold standard for safe and frictionless payments

Cards are, and will, remain a key payment method, projected to account for 56% of global consumer payment value by 2030. They continue to offer a highly secure and convenient way to make payments, particularly with key innovations like Click-to-Pay and tokenization. Policymakers should ensure card innovations continue to deliver its benefits to consumers and merchants.

5. Regulatory clarity drives innovation and growth in e-commerce

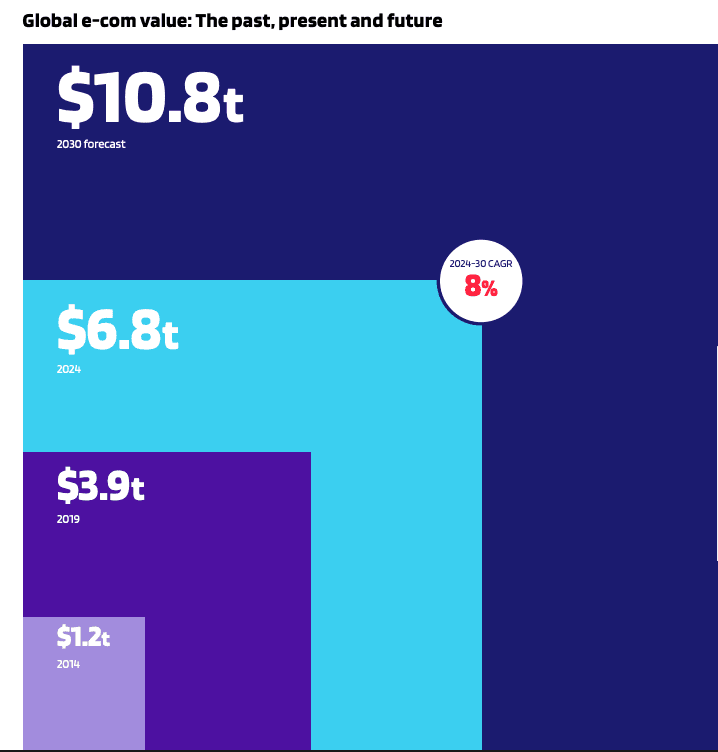

E-commerce has become an essential part of consumer life, with a projected 8% CAGR to 2030. Policymakers should promote a regulatory framework that can enable responsible payment innovations such as digital assets and AI and boost e-commerce transactions.

6. Striking the right balance between necessary and unnecessary frictions

While payments must always be reliable and safe, some excessive security measures for low-risk transactions can add unnecessary frictions and impede e-commerce growth. As both fraud and digital payment innovations evolve rapidly, it is vital for policymakers and the industry to work closely together and ensure that existing rules are still fit for purpose.

7. Promoting interoperability to unleash cross-border payments and international trade

The digital economy offers flexibility and possibilities beyond domestic use cases. Ensuring different payment methods and systems can work together, safely and efficiently, wherever consumers and merchants are located, is crucial in today’s globalized economies.

8. Cash declines but is not disappearing

While cash usage has fallen dramatically, it has reached a relative floor in certain markets and may remain important for potentially vulnerable demographics. Policymakers must ensure access to cash to promote financial inclusion and avoid premature pushes for a cashless society.

High-level regional takeaways for policymakers

North America

- Trends: Strong consumer preference for credit, debit and prepaid cards, with slower POS digital payment adoption.

- Policy focus: Modernizing digital payment infrastructure while supporting innovation and accessibility to all payment methods.

Europe

- Trends: Digital wallets dominate online transactions, primarily linked to bank accounts.

- Policy focus: Fostering interoperability among digital wallets to enhance usability and consumer choice.

Asia-Pacific (APAC)

- Trends: APAC is a world leader in digital payment adoption, with wallets the top choice in eight of the 14 APAC markets covered.

- Policy focus: Supporting fintech growth and innovation, while continuing to promote interoperability among digital wallets considering the importance of cross-border payments in APAC.

Latin America, Middle East & Africa

- Trends: Significant gains for digital wallets and A2A payments, with card networks staying prominent in many markets.

- Policy focus: Continuing to invest in digital payment infrastructure to deliver financial inclusion and payment choice.

The bottom line: Digital payments hold the key to unlocking economic growth

As the global payments ecosystem evolves rapidly, policymakers and industry leaders must work together to ensure payments continue to be safe and deliver growth. By embracing cooperation and responsible innovation, the next decade of payments can unlock unprecedented economic opportunities.

Anatole Baboukhian is Global Head of Government Affairs and ESG at Worldpay, where he leads global policy engagement on payments innovation, regulation and financial inclusion. With deep expertise at the intersection of fintech and public policy, Baboukhian advises on how governments and industry can shape a future-ready, secure and inclusive payments ecosystem.

Related Insights