Five tips from Thrive Street to make more of payments

Real-world lessons from small business merchants on making payments simpler, smarter and more secure.

For small to mid-sized business owners, every payment counts. From managing costs to improving the customer experience, how you take payments has a direct impact on your bottom line.

We spoke to business founders at Thrive Street, a vibrant three-day market curated by Mary Portas and powered by Worldpay and Mastercard, to find out how they make payments work for them.

Annie Hought from Round Retail, Nicole Stanton from NINI Organics and Ruth Winchester from DoodlePippin shared how they’re managing payments day-to-day and offer advice for making payments work harder for businesses.

1. Provide flexible ways to pay

Today’s shoppers expect payment flexibility – and small businesses that meet those expectations are more likely to convert browsers into customers. At Worldpay, we know people pay in multiple ways depending on the moment and situation they are in. Increasingly, offering choice in how to pay is critical to capture every sale.

Nicole Stanton from NINI Organics emphasized that payment options can make or break a purchase: “If they can’t pay how they want, they’re going to drop off online. You’ve got to offer that personal experience every single time.”

For Doodle Pippin, convenience is about speed: “As a consumer, I want to be able to pay instantly,” said founder, Ruth Winchester. In store, Round Retail’s Annie Hought sees demand for digital wallets: “Apple Pay is probably the No. 1. It’s one less thing to carry around.”

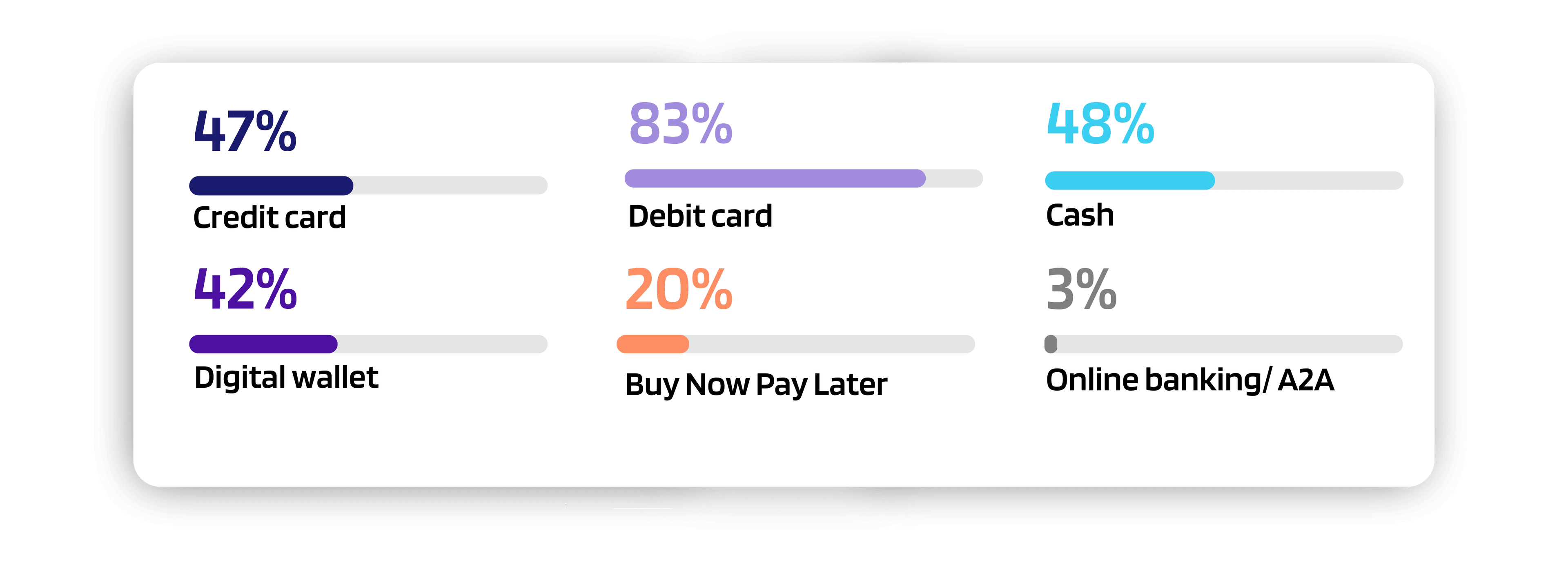

How UK shoppers paid in the last 12 months:

With 70% of UK shoppers selecting a channel based on convenience, giving customers choice in how they pay – including card, digital wallet, or buy now, pay later – removes friction, increases conversions and strengthens loyalty.

2. Prioritize payment security

Security is non-negotiable for maintaining customer trust and protecting both businesses and their customers – but it doesn’t have to be complicated. Partnering with payments providers who offer robust fraud protection takes the worry out of taking payments.

“In eight years, we’ve only ever had one chargeback and a few flagged fraudulent attempts,” said Stanton when asked about the benefits of using a trusted payments partner.

Winchester echoed that reassurance: “I value a provider that flags any concerns. I rely on them for security and wouldn’t want to handle it myself.” Hought’s experience is similar: “We use trusted providers and haven’t had issues with fraud or chargebacks.”

Choosing a payments partner with strong fraud monitoring helps protect revenue and reputation. With card fraud losses expected to reach nearly £300 billion globally over the next decade1 the right provider can save you time and stress, allowing you to focus on running your business.

3. Explore new tools to work smarter

Every transaction tells a story – about when and how customers are paying, what they’re purchasing and who they are. Analyzing patterns and trends helps businesses make better decisions about what to sell and how to refine their marketing efforts to reach customers at the right time.

Data helps you learn more about your customers and their preferences. Stanton explained that tracking these patterns allows her to plan effectively and create smoother buying experiences.

As businesses grow, though, administering processes manually can become a burden. Automating saves time and minimizes errors, freeing capacity for strategy and creativity. Hought estimates “one whole day a month” is spent cross-referencing payments and paying suppliers – time that might be redirected with the right tools.

AI goes a step further, helping to streamline workflows and to make faster, data-led decisions. With 53% of UK small and mid-sized businesses turning to AI tools to help run and optimize operations, adopting these technologies is becoming the norm. Winchester is already exploring its potential: “AI saves time and effort – especially with product descriptions and SEO – but I’m hesitant to use it for customer service because I want to keep that personal touch.” Using a payments provider with built-in AI capabilities can improve authorization rates and payment outcomes, giving businesses the foundation to grow.

Exploring a combination of tools – from automation for routine tasks to AI for insights and smarter business operations – allows businesses to streamline operations, improve accuracy and free up time to focus on what matters most.

4. Look beyond processing fees

While transaction fees are a cost of doing business, focusing only on the percentage rate can be short-sighted.

“You have to understand what you’re paying for and what you’re getting back,” said Hought.

“Paying the small percentage fee, I can accept that,” said Stanton. “That’s the last thing I would cut, because you win the customer, and our returning customer rate is high.”

A strong payments provider can improve authorization rates, prevent fraud, offer payment methods and deliver growth insights. Look at the total value, not just cost.

5. Be open to trying new things

Adaptability is one of the greatest strengths of small businesses. Whether it’s introducing new payment methods, trying out technology or rethinking your setup, staying open-minded and flexible helps you stay competitive.

Winchester believes in diversification: “Trying new things and expanding our offerings has really helped.”

The payments landscape evolves quickly, and so should your business. Regularly review what’s working, stay open to new opportunities and learn from the community around you.

Stanton’s advice is simple: “Don’t gatekeep. Share contacts and help others grow. Be open to change and willing to pivot based on facts, not feelings.”

Hought agreed that reflection is key: “Sometimes it’s OK to take a pause, step back and ask: What are we achieving here?”

From offering flexible payment options to streamlining admin, small businesses across the UK are proving that smart, adaptable payment strategies drive customer loyalty and growth.

Want to explore more practical tips and insights? Read our Payments guide for UK businesses – your essential guide to smarter, more profitable payments.

About the businesses

NINI Organics, founded in London by siblings Nicole Stanton and Alex Nicolaou, creates natural, ethical skincare products blending raw botanicals into fresh rituals.

Round Retail, founded by Annie Hought, is a charitable fashion resale platform that aims to bridge the gap between fashion resale and high street charitable shopping experiences.

DoodlePippin, founded by Ruth Winchester, creates millefiori designs, an ancient method of manipulating clay and glass to create intricate kaleidoscopic patterns and transforms these into jewelry, ceramics, glassware and household items.

Related Insights