Worldpay Innovation FocusPayout features that fuel your growth

Flexible payout experiences for your beneficiaries

1 in 2 consumers already use digital wallets*

Enterprise businesses in the U.K., E.U., U.S, Mexico and Chile can now send payments directly to wallets. Allow beneficiaries the flexibility to receive funds instantly in local currency and through their preferred digital wallet. Our network of wallet partners, including PIX, AliPay, Gcash, bKash, mPEsa, connects you to 3B+ beneficiaries for easier and faster payouts using the same integration as payouts to accounts. No extra setup required.

*2025 Global Payments Report, Worldpay

Refunds in minutes, not days

Long refund processing times can frustrate customers and impact loyalty. Issue refunds in the U.K. directly to Mastercard and Visa cards within 30 minutes in 120+ currencies. No more waiting for days, just faster refunds that keep customers coming back.

Note: Available for enterprise businesses.

Protect your margins

Enterprise businesses in the U.K. and Europe using payouts to accounts via API can now use two new FX features to manage currency risk and improve financial predictability:

- Lock in FX rates for up to 30 days to protect your business from market volatility and ensure more stable pricing

- Access real-time FX rates automatically refreshed every 30 minutes to make more informed decisions and optimize your payouts

Strengthen supplier relationships

Say goodbye to payment delays and complicated reconciliation. With Worldpay’s virtual card, U.K. and E.E.A. travel agents can streamline payments and build stronger supplier relationships.

- Reduce FX exposure by issuing payments in 16 currencies across 30+ countries

- Control spending by defining rules on how, when and where each virtual card can be used

- Simplify reconciliation by matching a single-use card to a specific booking and supplier payment

- Easily connect with your existing systems through a single integration

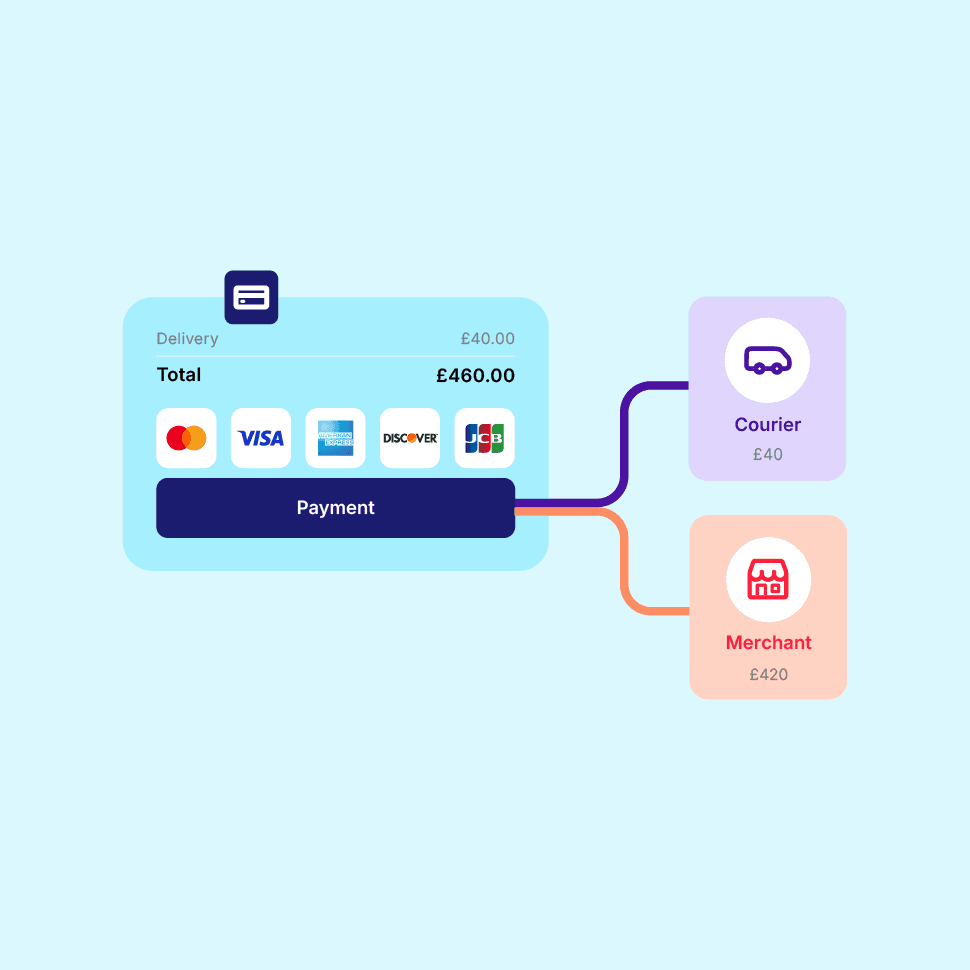

Split funding for marketplaces

EMEA marketplaces can distribute funds automatically without adding complexity to operations.

- Easily split a transaction across multiple recipients so your sellers and partners get paid correctly

- Set dynamic or fixed split rules, either by adjusting or applying a percentage across all sales

- Reduce reconciliation headaches and facilitate financial operations without scaling your back office