How agentic AI is changing digital purchases

Our latest research reveals that while most shoppers are curious about AI agents, they aren’t quite ready to hand over the keys to their wallets just yet.

This series explores how agentic commerce will impact the way entire industries operate – from gambling to retail, entertainment, digital content, financial services and travel – as AI agents begin to drive choices, transactions and loyalty.

Agentic commerce is poised to reshape how people shop, travel and manage money.

But rather than the futuristic idea of autonomous bots handling every aspect of our lives, early behavioural patterns show a more grounded reality. When it comes to AI agents, consumers are dipping their toes in rather than diving into the deep end. They’ll trust a bot to renew their streaming subscription, but they’re still booking the family vacation themselves.

For digital merchants, CFOs and finance leaders, this distinction is critical. The shift isn't about handing over the keys entirely; it's about identifying where consumers are willing to delegate. Understanding these early adoption curves – across verticals, spend levels and demographics – is the key to unlocking new revenue streams.

The 75% curiosity gap

Most shoppers aren't ready to hand over their wallets to a bot just yet. They’re in the 'undecided middle' – curious about the tech but keeping a firm hand on the 'buy' button.

Across global markets, data* indicates that only about one in four shoppers say they would 'never' use an AI agent. The remaining 75% are either ready to try it immediately or are persuadable, provided the right safeguards are in place.

However, 'ready' does not mean 'unrestricted.' Most consumers expect agentic AI to handle just 0–20% of their transactions initially. This signals that agentic AI is currently viewed as a helper channel – a tool to assist with the heavy lifting of research and routine – rather than a replacement for existing shopping behaviours.

Low stakes and lattes

Consumers favour agentic AI in structured, low-risk sectors like digital content, airlines and hospitality, and retail. These industries involve routine purchases, clear inventories and easy reversals for errors.

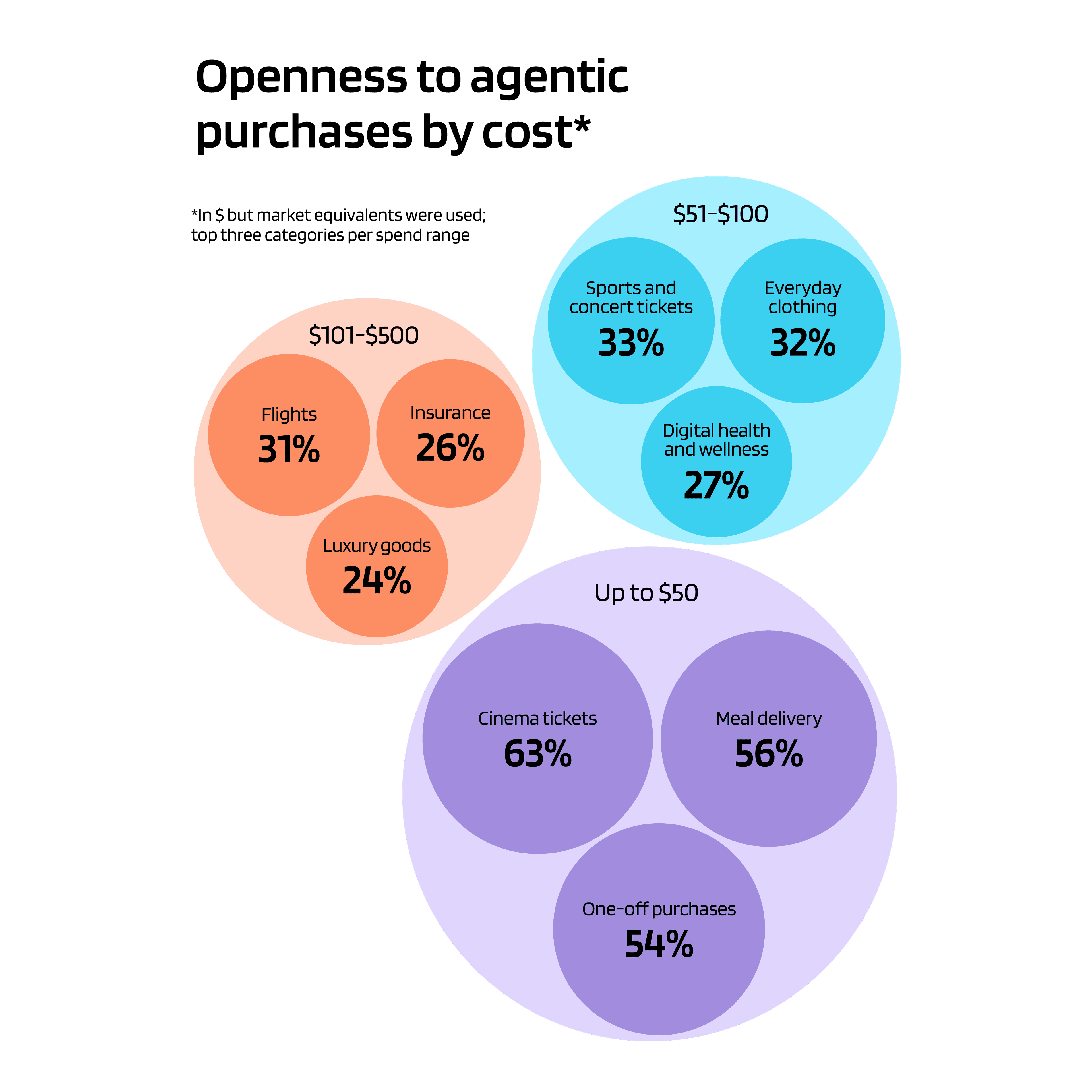

The impact of ticket size

Comfort with agentic AI varies by transaction value:

- Low-ticket spend (≤£50): Digital content leads in agentic AI adoption, covering subscriptions, in-app purchases and top-ups – ranking highest for purchases under £50 in four of seven surveyed countries; 53% of respondents globally trust agentic AI to manage subscriptions like streaming and video games.

- Medium-ticket spend (£51–500): Retail dominates with strongest interest in agentic AI purchase-interest in grocery and everyday buys; and flights and hospitality as a strong second.

- High-ticket spend (>£$500): Consumers hesitate to trust agentic AI with large, one-off digital purchases. On average, smaller amounts attract more willingness to use agentic payments. However, in Brazil and China, higher-ticket digital health services see greater agentic AI adoption than lower-ticket ones, suggesting opportunities for premium digital health services.

The demand for control varies by region

Trust in AI agents differs globally. In Western markets such as France, Australia and the UK, consumers strongly favour visible oversight. A significant share say they would never feel comfortable allowing an AI agent to browse and shop entirely on their behalf. Instead, interest centers on constrained use cases that include review-and-approve steps, clear spending limits and full transparency into AI-driven actions. In these markets, delegation is conditional and incremental.

'Agentic commerce systems must prioritise transparency.'

By contrast, consumers in China show greater comfort with reduced friction and real-time delegation. A larger proportion indicate they are willing to let an AI agent browse and transact on their behalf sooner, even with less emphasis on step-by-step approval.

This highlights a key design principle for merchants: Agentic commerce systems must prioritise transparency. Users need clear options to set rules, track activity and approve or block spending.

The generational shift

Adoption of agentic AI is not evenly distributed across age groups. The 25-44 age group shows the highest interest, closely followed by 18- to 24-year-olds. These groups are more open to trusting agentic AI with higher-value transactions. Older groups (45+) remain cautious, requiring stronger reassurance and control.

Among shoppers in the seven global markets surveyed, men are 23% more likely than women to trust agentic AI. However, in Brazil and China, women did report higher trust than men.

These nuances reinforce that demographic trends are directional, not universal.

Strategic implications for digital merchants

For CFOs and business leaders in the digital space, the path forward involves targeting specific, high-viability segments.

Q: Where are the most viable use cases right now?

A: Digital goods and services represent the most immediate opportunity for agentic commerce, ranking highest in consumer willingness for transactions under £50 across almost every major market. Consumers are already accustomed to and accepting of AI-led decisions for low-stakes transactions like subscriptions, automatic renewals and in-game microtransactions. This existing comfort level presents a clear and immediate opportunity for businesses to automate recurring revenue streams and optimise low-value transaction processes.

Q: Why do repeat-purchase models matter so much for agentic commerce?

A: Industries built on recurring revenue, such as SaaS, streaming services, video gaming and digital health platforms (e.g. coaching, wellness and nutrition services), are particularly well-positioned to capitalise on agentic commerce. The core advantage lies in shifting the customer relationship from a series of individual, high-friction sales to a single, upfront approval.

Once a consumer authorises an AI agent to manage a subscription journey, the business secures a predictable, low-friction revenue stream. By aligning initial agentic use cases with low-ticket, easily reversible expenditures, businesses can build the necessary consumer trust and comfort to eventually guide customers toward delegating higher-value decisions.

Q: How should merchants think about consumer trust and control?

Trust is not binary. Many consumers are open to agentic AI, but only with clear safeguards. In more conservative markets and among older demographics, control is a prerequisite, not a nice-to-have.

Features that were once considered optional must now be treated as foundational. This includes:

- Implementing review-and-approve workflows before a transaction is executed

- Allowing users to set explicit spending caps

- Providing transparent and accessible rule-setting interfaces

- Ensuring that any AI-driven action is clearly and easily reversible

These elements are not just enhancements; they are non-negotiable prerequisites for building trust and driving adoption among more hesitant consumer segments.

Q: Do these strategies need to vary by market and demographic?

A: Absolutely. Adoption of agentic AI differs significantly by region, age and gender. Western markets tend to demand higher visibility and oversight, while some Asian markets show greater comfort with autonomous behaviour. Younger consumers are more open to experimentation, while older groups require stronger reassurance.

For merchants, this means agentic commerce cannot be deployed as a single global experience. Flexibility, localisation and options are critical to driving adoption without alienating more cautious customers.

Leading with trust

The agentic economy isn’t a switch; it’s a scale. Success for merchants won't come from forcing total automation, but from building trust through transparent, secure and streamlined experiences.

* Data source: Insights are based on multi-country research by Worldpay across seven markets: the US, UK, France, Brazil, Australia, China, and Singapore. The study measured willingness to use AI agents, comfort with spending and adoption by sector.

Related Insights